|

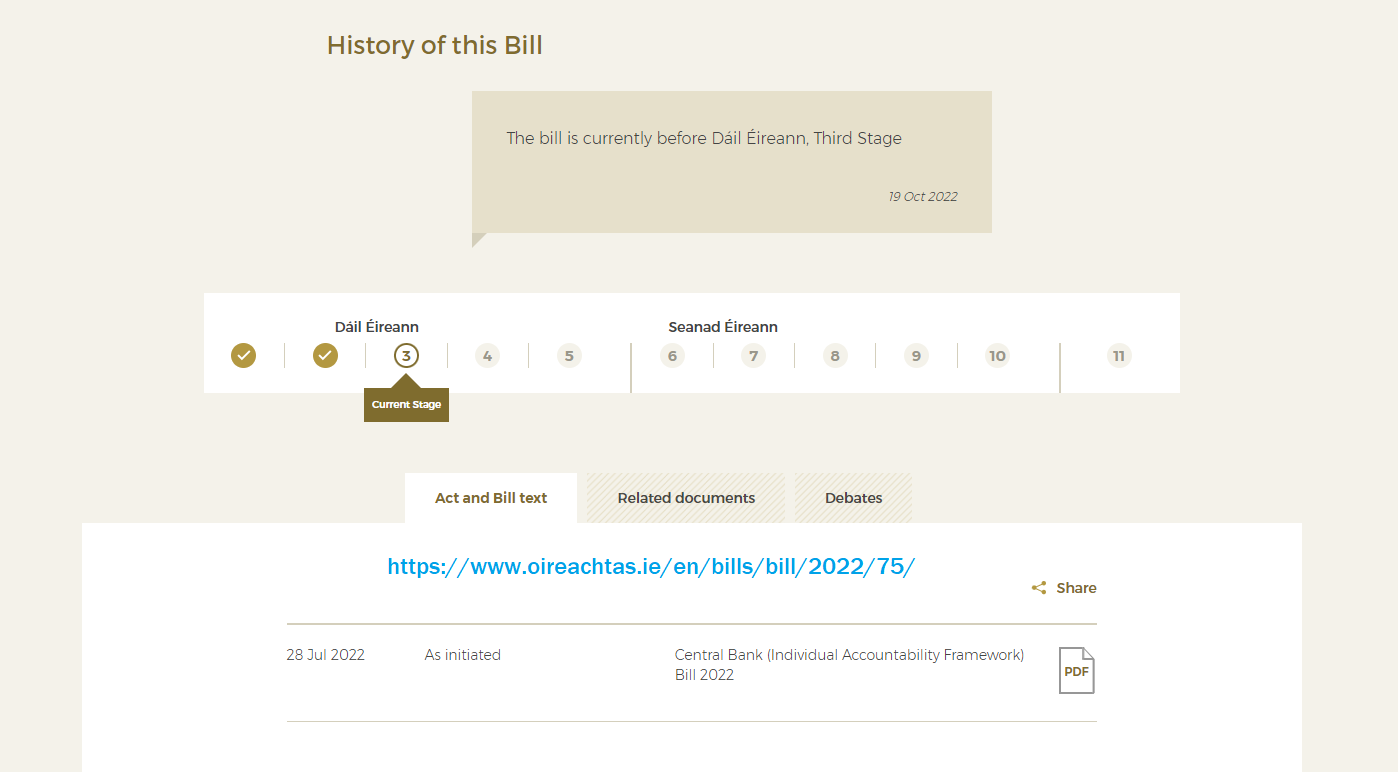

On 19 October 2022, the Central Bank (Individual Accountability Framework) Bill 2022 ("Bill") commenced its journey to the Third Stage after being referred to the Select Committee on Finance, Public Expenditure and Reform, and Taoiseach pursuant to Standing Orders 95 and 181. The Bill passed through the Second Stage on 18th and 19th October. On 18th October Minister for State at the Department of Finance (Deputy Sean Fleming) moved that the Bill be now read a Second Time. Much of the detail of the individual accountability framework, including the initial scope of the SEAR, will be included in future Central Bank regulations. You will not find that detail in the current draft of the Bill. Ahead of making such regulations, the Central Bank intends to conduct a comprehensive consultation exercise. The Minister said "I strongly urge all industry participants to engage constructively with this consultation process. Before the main provisions of the Bill are outlined, I will take this opportunity to flag the Minister's intention to propose a number of minor amendments on Committee Stage." The Minister also stated that the Bill:

Central Bank Consultation Process (as noted above): The Minister said "Much of the detail of the individual accountability framework, including the initial scope of the SEAR, will be included in the Central Bank regulations. Ahead of making these regulations, the Central Bank intends to conduct a comprehensive consultation exercise. I strongly urge all industry participants to engage constructively with this consultation process. Amendments Proposed at Committee Stage (as noted above): The Minister said "Before the main provisions of the Bill are outlined, I will take this opportunity to flag the Minister's intention to propose a number of minor amendments on Committee Stage." Locate a copy of the Bill as initiated on 28 July 2022 and the accompanying Explanatory Memorandum here. Posted by: Peter Oakes, Founder of CompliReg a leading specialist governance, regulatory and compliance strategy firm. Peter established and led the Enforcement and AML/Supervision Directorate of the Central Bank of Ireland as its inaugural Assistant-Director General, then later Director of Enforcement and AML/CFT Supervision.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorThe Authors of new, views and blogs appearing here are cited in the relevant blog and are responsible for their content. Archives

November 2023

Categories

All

|

RSS Feed

RSS Feed