|

The Regulatory Impact Assessment for the Central Bank (Individual Accountability Framework) Bill From Department of Finance - Revised July 2022 - was published by the Department of Finance on Friday 4 November 2022. Regulatory Impact Assessment (and Behaviour and Culture of the Irish Retail Banks July 2018 referred to in the RIA). Further Reading:

A short summary of some of the points raised in the RIA: 1. Summary of Regulatory Impact Analysis (RIA) Two policy options were considered #1. No intervention and #2. Implement an Individual Accountability Framework based on the recommendations put forward by the Central Bank of Ireland in the 2018 report “Behaviour and Culture of the Irish Retails Banks”. Option #2 is the preferred option. 2. Policy Context and Objective Government’s objective is as outlined in the Programme for Government: Our Shared Future, to introduce the Senior Executive Accountability Regime (SEAR) to deliver heightened accountability in the banking system. Failings within the financial industry in the financial crisis and in specific instances in recent years. These failings have had severe financial and other consequences for customers of the financial sector. There have been negative financial and reputational impacts for financial institutions with low levels of public trust. Serious shortcomings in the culture of Irish retail banks were identified in the Central Bank’s 2018 report, ‘Behaviour and Culture of the Irish Retail Banks’, prepared at the request of the Minister for Finance following revelations relating to banks’ treatment of customers with tracker mortgages. 3. Identification and Description of Options

The IAF will provide for obligations on regulated financial service providers with respect to governance, management arrangements and senior executive accountability. It will also provide clarity to firms and to the regulator as to who is responsible for what, and how decisions are made within firms. Enhancing individual accountability is integral to the regulation of firms, sets a solid foundation for more efficient communication and quicker resolution of issues, and improves decision-making. The ambition is to foster an effective culture and clarity of responsibilities such that staff and senior managers within firms promote consumer interests and proactively address problems.

Additional Conduct Standards will be introduced alongside the Common Conduct Standards. These standards will apply (in addition to the Common Conduct Standards) to more senior persons, those performing pre-approval controlled functions in relation to all RFSPs and others who perform any other function by which the person may exercise a significant influence on the conduct of the RFSP’s affairs. Persons in such senior roles will be required to take reasonable steps to: (a) ensure that the business of the RFSP for which the person is responsible is controlled effectively; (b) ensure that the business of the RFSP for which the person is responsible complies with relevant regulatory requirements; (c) ensure that any delegation of tasks for which they are responsible is to an appropriate person and that they oversee the discharge of the delegated task effectively; (d) disclose promptly and appropriately to the Central Bank any information of which the Central Bank would reasonably expect notice; and (e) participate effectively in collective decision making. Standards for Businesses will apply to all firms who are regulated by the Central Bank. The Bill provides for a new regulation-making power for the Bank to prescribe business standards with which Regulated Financial Service Providers (RFSPs) shall comply to ensure that they act in the interests of customers and of the integrity of the market, act honestly, fairly and professionally and act with due skill, care and diligence. The Bill provides for the sanctioning of individuals and firms who breach their responsibilities under financial services legislation for failures to meet the relevant conduct standards. The Conduct Standards will provide clarity to both individuals and firms as to the behaviours that are expected of them and are intended to be instrumental in improving behaviour and culture within the sector. The Bill provides that the Central Bank will prepare and publish guidance in relation to the Conduct Standards and include a requirement for regulated firms to inform staff and provide training with regard to the responsibilities to be imposed on them.

The Conduct Standards will complement the existing F&P Regime by delineating the responsibilities of CFs (including PCFs). The introduction of a certification regime will oblige firms to certify on an annual basis that its CF staff are fit and proper persons to perform their functions. A positive duty on firms to certify each CF will strengthen the regime and increase the focus on the responsibility of firms for the conduct of their staff and their corporate culture. The F&P regime will be extended to apply to financial holding companies based in Ireland, including investment holding companies, following adaptation of EU legislation relating to such companies into Irish law since the General Scheme was published.

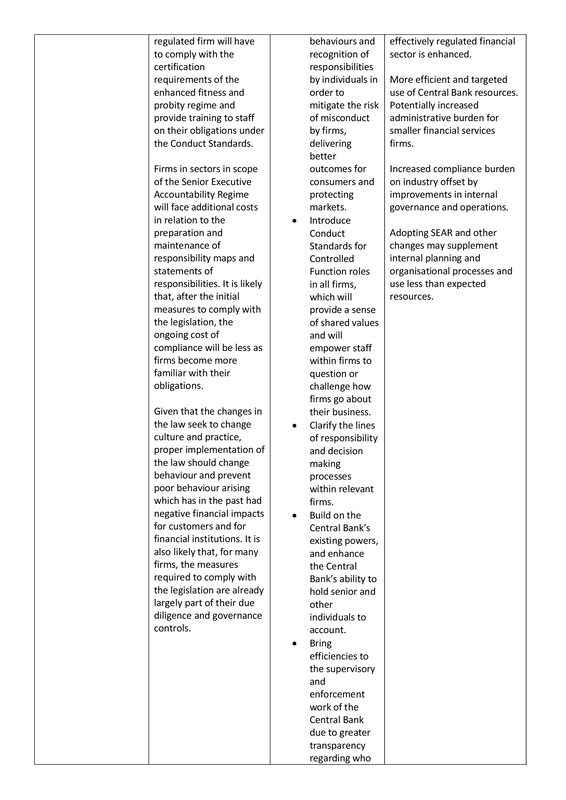

4. Analysis of costs, benefits and other impacts for each option 5. Consultation The objective of the introduction of an Individual Accountability Framework is to achieve better outcomes for consumers, to improve the sustainability of the financial system and to drive higher standards of behaviour and governance in financial services firms. The Department engaged with the Central Bank following the publication of its Report on “Behaviour and Culture of the Irish Retails Banks”, in order to devise policy to ensure that the Central Bank has the powers it needs to regulate effectively, while safeguarding the constitutional rights of all concerned. The Department has engaged at length with the Attorney General’s Office and the Central Bank to ensure that the legislation is both effective and constitutionally robust. The additional powers that will be provided to the Central Bank are significant, and it is important that the correct balance between these powers and the protection of individuals’ constitutional rights is struck. It is also imperative that the new provisions can withstand legal challenge. Officials from the Department engaged with industry representative bodies throughout the process in seeking it views on the matters to be addressed in the Bill and, where appropriate, the provisions of the Bill reflects the outcome of that engagement. The broad outlines of the legislation have also been flagged in responses to Parliamentary Questions and in speeches by the Minister and by senior officials of the Central Bank. 6. Enforcement and Compliance The proposal will be implemented by way of primary legislation. Incorporated in this is a requirement for Oireachtas approval for both the Bill and any future amendments to the Act thereafter. The Bill provides the Central Bank with powers to enforce compliance with the legislation. 7. Review

8. SME Test All SME who are regulated by the Central Bank will be subject to provisions of the Bill. In line with the guidance issued from the Department of Enterprise, Trade and Employment regarding the impact of the proposed legislation on SME the Department has engaged with relevant representative bodies to gather their views on the impact of the provisions. The legislation, which was welcomed in the main by those consulted, provides for clarity, proportionality, safeguards for those to be subject to the provisions to be underpinned by clear guidance from the Central Bank to address the concerns raised. The Central Bank has committed to undertaking a comprehensive public consultation paper for comment by all stakeholders post enactment. As part of that process, the Bank will consider all comments received, update the guidance and regulations where appropriate and issue final guidance and regulations. In addition, the Central Bank will issue a feedback statement which will summarise all comments received, indicate whether action has been taken to amend the guidance and regulations on the basis of those comments and, where action is taken to amend them, set out the change clearly with cross references to the relevant section of the guidance and regulations. The Minister for Finance will have oversight of the regulations to be made as provided for in Part 8 of the Central Bank (Supervision and Enforcement) Act 2013. 9. Publication This RIA and any future versions of the document shall be published in accordance with the RIA Guidelines for publication. It shall be published on the Department of Finance website and accompanied by a link to the Bill. Posted by: Peter Oakes, Founder of CompliReg a leading specialist governance, regulatory and compliance strategy firm. Peter established and led the Enforcement and AML/Supervision Directorate of the Central Bank of Ireland as its inaugural Assistant-Director General, then later Director of Enforcement and AML/CFT Supervision.

0 Comments

|

AuthorThe Authors of new, views and blogs appearing here are cited in the relevant blog and are responsible for their content. Archives

November 2023

Categories

All

|

RSS Feed

RSS Feed